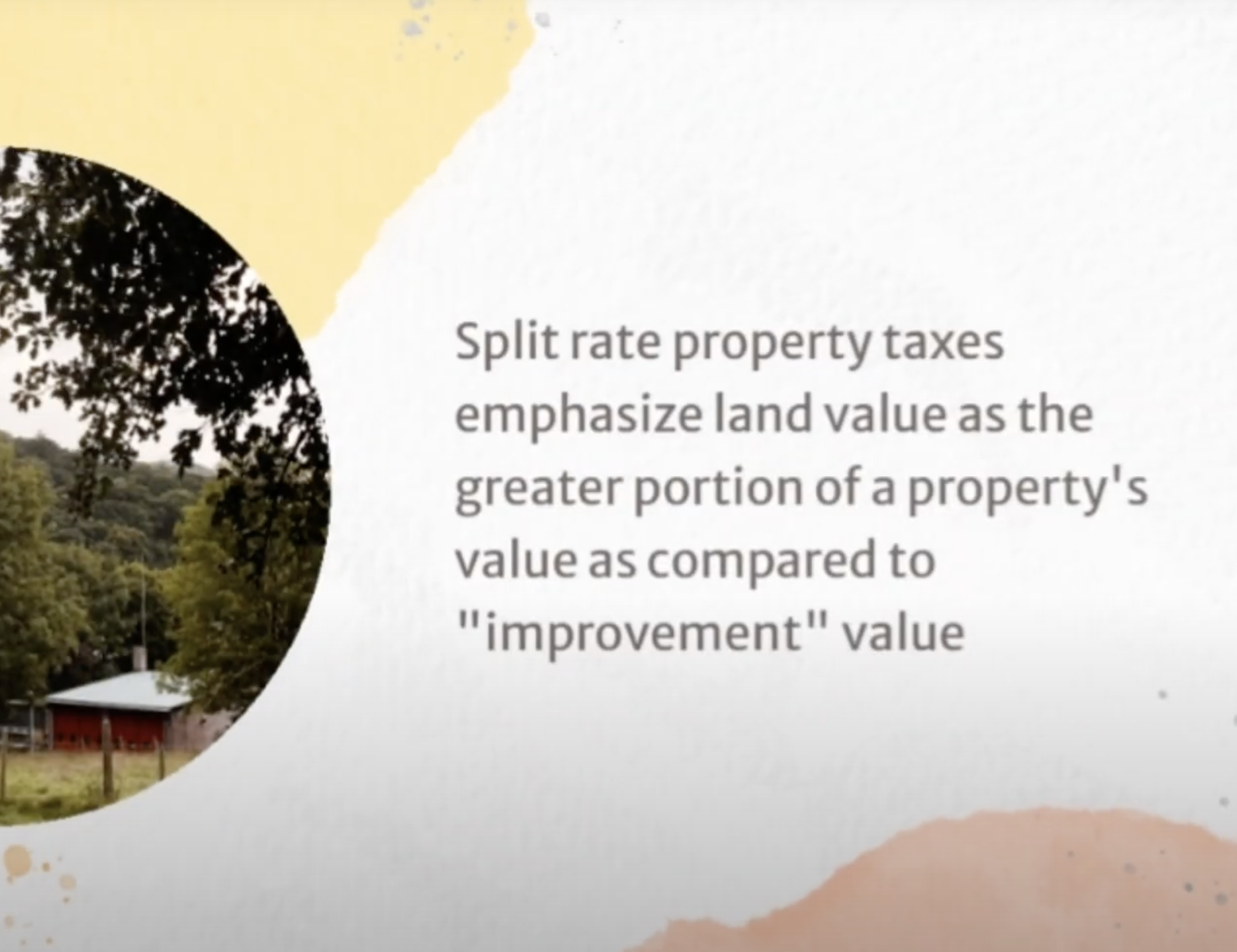

Split Rate Taxes: Thomas McKiernan’s Explainer Video

Student

Thomas McKiernan (M.R.P. '24)

Class

CRP 3850/5850 Special Topics in Planning: Economic Development: Goals, Strategies, and Tools

Instructors

-

Thomas Knipe

Each fall semester, Visiting Lecturer Thomas Knipe teaches a course in economic development panning. Knipe is an alumnus of the Cornell Masters in Regional Planning Program, from which he graduated in 2011. Knipe currently serves as the Director of Economic Development for the City of Ithaca, New York.

Thomas McKiernan (M.R.P. '24) describes the important economic development topic of Split Rate Taxes.